When you walk into a clinic or urgent care center, you might not think about how much the staff paid for the antibiotics, lidocaine, or saline solutions they’re about to use. But behind the scenes, a quiet revolution is happening in how these everyday drugs are bought - and it’s saving clinics, hospitals, and patients real money. Bulk purchasing of generic medications isn’t just a cost-cutting trick. It’s a strategic, data-driven approach that’s reshaping how healthcare providers manage their drug budgets - especially when they’re dealing with high-volume, low-cost generics.

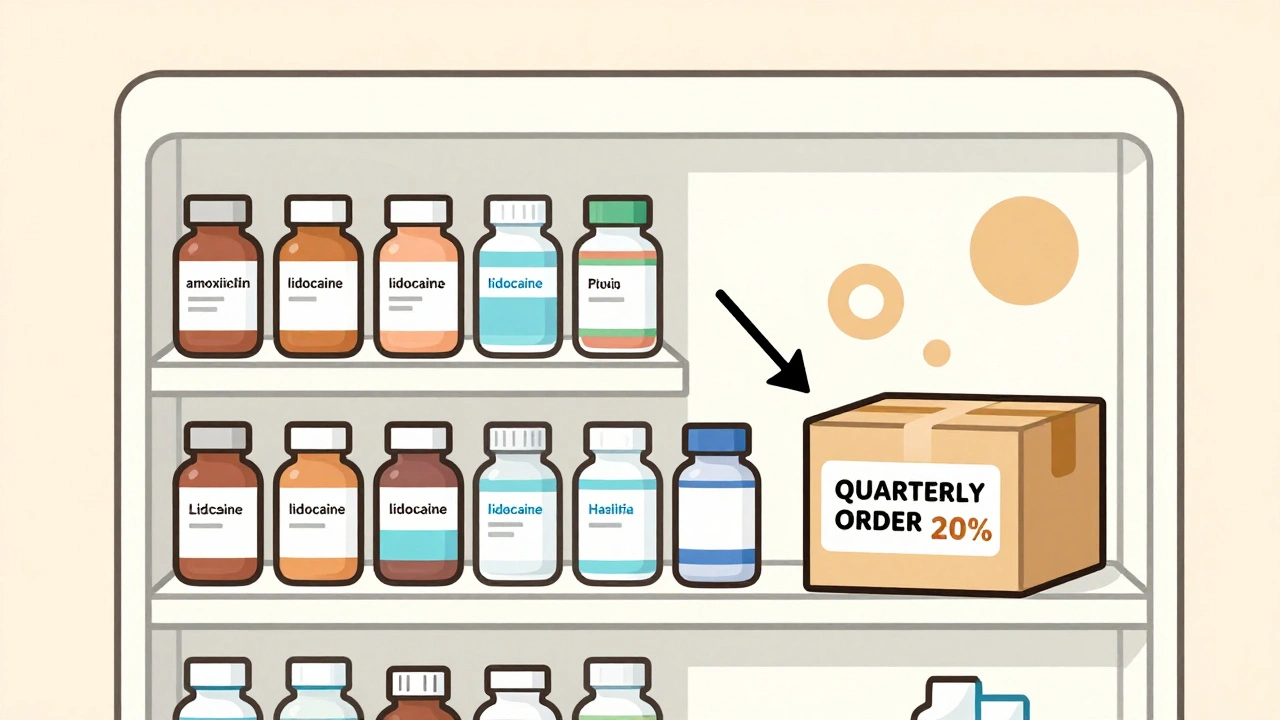

Let’s start with the numbers. In the U.S., generic drugs make up over 90% of all prescriptions filled. Yet they account for only about 25% of total drug spending. That gap? It’s not because generics are cheap - it’s because the system is full of middlemen, rebates, and opaque pricing. Bulk purchasing cuts through that noise. By buying large quantities directly or through specialized distributors, providers can lock in discounts that range from 20% to 30% off standard prices. That’s not theoretical. A Texas urgent care center slashed its injectable drug costs by 20% in just two months by switching from monthly orders to quarterly bulk buys and using short-dated stock - drugs with six to twelve months left on their expiration date.

How Bulk Purchasing Actually Works

Bulk purchasing doesn’t mean just ordering more pills at once. It’s a system built on volume, timing, and structure. There are three main ways providers get discounts:

- Direct volume discounts: If you buy over 1,000 units of a drug in one order, manufacturers or wholesalers often give you 5-15% off. For orders over 10,000 units - think a small hospital or multi-location clinic - discounts can hit 20-30%.

- Rebates from PBMs: Pharmacy Benefit Managers (PBMs) negotiate rebates with drugmakers based on how much they move. These can be 15-40% off, but here’s the catch: not all of that savings reaches the provider. Studies show only half to 70% of PBM rebates actually lower costs for clinics or insurers.

- State and multi-state purchasing pools: Groups like the National Medicaid Pooling Initiative (NMPI) or Sovereign States Drug Consortium (SSDC) combine the buying power of dozens of states. They get an extra 3-5% off just by negotiating as one big buyer instead of 50 separate ones.

Secondary distributors - companies like Republic Pharmaceuticals - are where many small providers get the best deals. Unlike the big three wholesalers (McKesson, Cardinal Health, AmerisourceBergen), which control 85% of the market, secondary distributors specialize in bulk generics and short-dated stock. They don’t have the same overhead, so they pass on bigger savings. One Ohio clinic cut its injectable costs by 25% using short-dated stock from a secondary distributor. The drugs were still perfectly safe - just closer to expiration. With smart inventory tracking, they used every last vial.

What Drugs Benefit Most

Not all generics are created equal when it comes to bulk buying. The biggest savings come from drugs that are:

- Highly used: Think antibiotics like amoxicillin, pain relievers like lidocaine, steroids like prednisone, and IV fluids like normal saline.

- Stable and non-perishable: Tablets and capsules last years. Injectable solutions need more care, but still have long shelf lives if stored properly.

- Not in short supply: During a shortage, even bulk buyers can’t get what they need. As of November 2023, the FDA listed 298 active generic drug shortages - from insulin to antibiotics. Bulk purchasing doesn’t help when the supply chain breaks.

Specialty drugs - expensive, rare, or complex medications - aren’t good candidates. You won’t save money buying 10,000 units of a drug that only 5 patients in your clinic need each year. The risk of waste outweighs the discount.

Real-World Savings: A Case Study

A small urgent care network in Texas had a problem: their monthly drug bill kept creeping up. They were ordering antibiotics, lidocaine, and saline every four weeks from their primary wholesaler. The prices were fixed. No discounts. No flexibility.

They switched 60% of their purchases to a secondary distributor. Here’s what they did:

- Identified their top 18 drugs - these made up 70% of their medication spending.

- Switched to quarterly bulk orders instead of monthly.

- Started buying short-dated stock for injectables with expiration dates within 8-12 months.

- Installed a simple inventory tracker in their EHR to flag drugs expiring in 60 days.

Two months later, their drug costs dropped 20%. They didn’t change their formulary. They didn’t cut corners on quality. They just changed how they bought. Their staff spent about 20 hours total during the first month learning the new system. After that, it took 5-10 hours a month to maintain.

The Hidden Costs and Pitfalls

Bulk purchasing isn’t magic. It comes with trade-offs.

Upfront cash flow: Buying 10,000 tablets at once means paying more money upfront. A 2023 MGMA survey found providers needed 15-25% more working capital to make bulk buying work. That’s tough for small clinics with tight budgets.

Minimum order requirements: Many distributors require you to buy a minimum number of units - sometimes more than you’ll use in a year. One urgent care center told a survey they were forced to buy 500 vials of a drug they only needed 150 of. They ended up wasting 10% before expiration.

Inventory management: Short-dated stock saves money - but only if you use it before it expires. A 2023 review found 28% of provider complaints were about expired drugs. Success means tracking expiration dates daily, not monthly. Automated alerts in your EHR system are a must.

Supplier chaos: Working with multiple distributors - a secondary one for generics, a primary one for branded drugs, maybe a 340B program for safety-net patients - can get messy. One Florida clinic manager said: “We got better prices, but now we have three different invoices, three different delivery schedules, and three different customer service lines.”

What’s Changing in 2025

The rules are shifting. The Inflation Reduction Act’s Medicare drug price negotiation program is starting to roll out. By 2026, it’s projected to cut spending on 10 high-cost drugs by 38-79%. That’s a game-changer - but it only affects a handful of drugs. For the rest - the 90% that are generics - bulk purchasing remains the most powerful tool.

Point-of-sale discounts are also becoming automatic. Instead of handing patients a discount card, pharmacies now apply negotiated bulk prices directly at checkout. For common generics like metformin or atorvastatin, patients are seeing out-of-pocket costs drop by 30-50%. That’s not because the drug got cheaper - it’s because the system finally passed savings along.

The FTC is also cracking down on price manipulation. With 17 active investigations into drugmakers and PBMs as of late 2023, transparency is rising. That means more predictable pricing - and better opportunities for smart buyers.

Who Should Do This - and Who Shouldn’t

Bulk purchasing works best for:

- Urgent care centers

- Podiatry and dermatology clinics

- Community health centers

- Small hospitals with steady patient volume

It’s less useful for:

- Specialty pharmacies

- Single-doctor practices with low drug volume

- Clinics in areas with frequent drug shortages

If you’re buying fewer than 500 units of a drug per year, stick with your regular supplier. The savings won’t justify the hassle.

Getting Started: A Simple 4-Step Plan

Here’s how to begin bulk purchasing without overcomplicating it:

- Track your top 20 drugs: Use your pharmacy records to find the 15-20 medications that make up 60-70% of your spending.

- Find a secondary distributor: Look for companies like Republic Pharmaceuticals that specialize in bulk generics and short-dated stock. Compare their formulary, minimum orders, and delivery times.

- Start small: Pick one drug - say, amoxicillin - and order a bulk quantity. Track how much you use over the next 90 days.

- Automate: Set up alerts in your EHR for drugs expiring in 60 days. Use that data to adjust future orders.

Most providers see results within 60 days. The biggest win? You’re not just saving money - you’re taking control of your supply chain.

Is bulk purchasing safe for patient care?

Yes. Generic drugs bought in bulk - even short-dated stock - are identical in quality, safety, and effectiveness to brand-name or regular stock. The FDA requires all generics to meet the same standards. The only difference is the expiration date. As long as you use the drug before it expires and store it properly, there’s no risk to patients.

Can small clinics afford bulk purchasing?

Absolutely. You don’t need to buy 10,000 units at once. Many secondary distributors offer bulk discounts starting at 1,000 units. For a clinic that uses 300 amoxicillin tablets per month, buying 1,200 every four months is manageable. The key is starting with one or two high-volume drugs and scaling up.

Do I need special software to track bulk inventory?

You don’t need fancy software, but you do need a system. Many EHR platforms let you set expiration alerts. At minimum, use a simple spreadsheet to log incoming shipments, expiration dates, and usage. One Texas clinic used Google Sheets and still saved 20% - no tech upgrade needed.

What’s the difference between a primary wholesaler and a secondary distributor?

Primary wholesalers (McKesson, Cardinal, AmerisourceBergen) are the big players that supply most pharmacies. They offer standard pricing with small volume discounts. Secondary distributors focus on bulk and short-dated stock. They have fewer drugs available, but better prices - often 20-25% cheaper - because they cut out layers of the supply chain.

Are rebates from PBMs worth it for clinics?

Usually not. PBMs negotiate rebates with manufacturers, but they often keep most of the savings. Studies show only 50-70% of those rebates go to the provider. For clinics, direct bulk discounts from distributors are more reliable and transparent.

What happens during a drug shortage?

Bulk purchasing can backfire. If you’ve committed to buying 5,000 units of a drug and the manufacturer runs out, you’re stuck. That’s why it’s smart to diversify - keep some inventory from your regular supplier, and avoid locking in large orders on drugs with a history of shortages. Always check the FDA’s Drug Shortage Database before placing bulk orders.

If you’re paying full price for generics, you’re leaving money on the table. The system is built to reward those who buy smart - not just buy more. With a little planning, even the smallest clinic can cut drug costs by 20% or more. That’s not just savings. That’s money that can go back into patient care - more staff, better equipment, or lower copays. Bulk purchasing isn’t about squeezing suppliers. It’s about fixing a broken system - one bulk order at a time.

Comments (11)

Bulk purchasing of generics is one of those quiet, systemic wins that rarely make headlines but saves millions annually. The key insight isn't just buying in bulk-it's recognizing that the current supply chain is artificially inflated by layers of middlemen who add cost without value. Secondary distributors bypass that entirely, and the fact that short-dated stock is still perfectly safe is a testament to how robust FDA regulations are. This isn't cutting corners; it's cutting out the fluff.

Oh wow, so the system’s broken but we’re just supposed to be grateful someone figured out how to game it? Classic. PBMs get 40% rebates and providers get crumbs, while the patient still pays $15 for amoxicillin because ‘insurance negotiated pricing’ is just corporate speak for ‘we kept the money.’ Meanwhile, the guy in Ohio is using expired-looking vials like a boss and saving 25%. The real scandal isn’t the drug shortage-it’s that we let this mess go on for decades.

OMG I just cried reading this. 🥹 In India, we know this pain so well-pharmacies charge 5x for the same medicine because of ‘distribution chains’ and ‘brand premiums.’ But here in the US, you’re actually fixing it? That’s beautiful. I work in a clinic where we buy 500 tablets of metformin at a time and still pay too much. This guide? I’m printing it. And sharing it with my sister who’s a nurse in Texas. Thank you for making this so clear.

This is a masterclass in healthcare economics disguised as a practical guide. The structural inefficiencies inherent in pharmaceutical procurement are not merely logistical-they are ideological. The current paradigm privileges opacity over transparency, intermediation over integration, and profit extraction over patient welfare. The emergence of secondary distributors represents a decentralized, market-driven correction to this imbalance. Moreover, the utilization of short-dated stock, far from being a compromise, is a paradigmatic example of resource optimization aligned with ethical stewardship. One must question why such practices are not universally mandated, rather than treated as fringe innovations.

Bro this is literally life-changing. 🙌 I run a small clinic in Hyderabad and we’ve been paying insane prices for everything because we thought we had no choice. After reading this, I reached out to a secondary distributor last week-ordered 1,200 amoxicillin tablets and 500 saline vials. We used to spend $800/month on meds. Now it’s $580. And guess what? We haven’t lost a single patient to expired meds because we started using Google Sheets with color-coded expiry alerts. I’m literally dancing in my office. If you’re reading this and still buying from McKesson? You’re bleeding money. Stop. Just stop. And start here. 🚀

This whole thing is a scam. You think you're saving money but you're just creating inventory nightmares. Every clinic that tries this ends up with a closet full of expired lidocaine and a pissed-off staff. And don't get me started on secondary distributors-half of them are unlicensed fly-by-nights. The FDA doesn't monitor them like the big wholesalers. You're gambling with patient safety for a 20% discount. And then you wonder why malpractice insurance is so high.

Interesting. But you didn’t cite any peer-reviewed studies. Where’s the data on waste rates for short-dated stock? And you mention a Texas clinic saved 20%-but was that adjusted for inflation? Labor costs? Staff training hours? This reads like a brochure for a secondary distributor.

Y’all are overthinking this. 😊 I run a tiny clinic in Nebraska. Bought 1,000 amoxicillin tabs from a secondary guy for half price. Used ‘em all. No drama. No chaos. Just saved $300/month. My nurse even said, ‘Hey, can we do this with the saline too?’ That’s it. No spreadsheets. No PhD needed. Just do it.

How dare you suggest that American healthcare can be optimized by learning from developing nations? In India, people die waiting for basic medicines because of corruption and poor infrastructure. Here, we have standards. You think buying expired drugs is innovation? That’s not efficiency-that’s desperation. This post reads like a socialist manifesto disguised as medical advice. The real solution is to fix the broken patent system, not exploit loopholes in the supply chain.

I love how this post breaks it down so simply. I work with a network of 12 clinics in rural India and we’ve been trying to do something similar for years. The challenge is trust-we don’t know which secondary distributors are legit. But your point about checking the FDA shortage list? That’s gold. We’re starting with metformin and insulin glargine next month. Also, shoutout to the Texas clinic-your Google Sheets method is now our template. Let’s build a shared spreadsheet for clinics in South Asia to track reliable distributors. Anyone in?